City Services and Notices

Update:2026/1/30

The Plaza of Multicultural Exchange Sakai (POME Sakai) can help you with language assistance for any of the processes in the city notices listed here.

- Declaration for Municipal and Prefectural Tax

- Temporary Closure of Sakai City Museum

- Japan has a universal health insurance system

- National Pension Contribution Special Payment System for Students

- Fines will be introduced for bicycle traffic violations!

- Reduction of National Health Insurance Premium Before and After Delivery

- National Pension Contributions Exemption Before and After Delivery

- Do you know about the foster care system?

Tax Payment

February is the fourth appointed time for Fixed Property Tax and City Planning Tax. The payment deadline is March 2nd. Please make your payment by the deadline at your nearest financial institution, convenience store, etc. Payment can also be made using Pay-easy, mobile payment methods, and credit cards via the regional tax payment website (eLTAX). Click here for the English user’s guide on the website (eLTAX). For those using automatic withdrawal, the fourth appointed time for Fixed Property Tax and City Planning Tax will be withdrawn on March 2nd. Please ensure you have sufficient funds in your account.

Declaration for Municipal and Prefectural Tax

This is an important procedure which provides the basis for the calculation of taxes in FY2026 and also enables taxpayers to be issued with tax certificates such as “Proof of Income” (所得証明). Please complete the declaration during the designated period. To prevent congestion, please submit documents by post. The forms are available on the Sakai City Government website.

Who needs to make a municipal and prefectural tax declaration?

Anyone who had an address within Sakai City as of January 1st 2026 and received income in 2025, excluding:

● anyone who informs the national tax office of his/her income individually

● anyone whose income is solely derived from wages and the place of employment automatically informs the municipal government of their earnings

● anyone whose income during 2025 is from public pension only and 1.55 million yen and under (1.05 million yen and under for those born on January 2nd 1961 and after)

If you had no income in 2025, but still want to receive a “Proof of Income”, please make a declaration.

Declaration period: February 16th to March 16th (excluding weekends and public holidays), 9:00-17:00

Place: City Hall Main Building 3F Meeting Room, Naka/Higashi/Minami Ward Office 2F Meeting Room, Nishi Ward Office Basement Meeting Room, Kita Ward Office 1F Meeting Room, Mihara Ward Office Main Building 3F Meeting Room

Necessary Items:

● A document that can prove your earnings, e.g. income tax withholding slip (源泉徴収票)

● A document that can prove a deduction from your income, e.g. payment receipts of national health insurance (国民健康保険)

● Identification documents of the person filing the declaration (Residence Card, My Number Card, etc)

Temporary Closure of Sakai City Museum

The Sakai City Museum is currently closed for air-conditioning system renovations. It will reopen on April 1st, so please come and visit from then. Meanwhile, the Sakai City Tea House “Shin-an” remains open as usual, except on Mondays.

Japan has a universal health insurance system

In Japan, everyone is required to enroll in public health insurance to ensure access to medical care with peace of mind. Programmes such as National Health Insurance and the Medical Care System for the Elderly are part of this framework. These systems are based on mutual support, with all insured individuals contributing to help one another. Let’s work together to protect healthy living for everyone.

● Eligibility for enrollment

You must enroll if you are a foreign national who is permitted to stay in Japan for over 3 months. However, there may be cases where enrollment is not possible. Click the links below for details about the enrollment conditions and how to enroll.

● Insurance premiums and medical expenses

When you enroll in health insurance, premiums are charged based on your income and household composition. In addition, you can receive medical care by paying 20-30% of the medical costs yourself (10-30% for the Medical Care System for the Elderly). The exact percentage depends on factors such as income.

Those under 74 years National health insurance

Those aged 75 and older Elderly person health insurance (Japanese only)

The deadlines for February and March are as follows

February: March 2nd

March: March 31st

National Pension Contribution Special Payment System for Students

If a student’s income for the previous year is below a certain amount (1.28 million yen if there are no dependents), national pension contribution payments for that period can be deferred upon application. The approved period will count toward the eligibility requirement for receiving a pension; however, it will not increase the pension amount. If an accident or illness during this period results in a disability, the Basic Disability Pension may be paid if certain conditions are met. To apply, please bring your pension book or Notification of Pension Number, a personal identification document such as My Number Card, and either student ID or certificate of enrollment to the Health Insurance and Pension Division at your local ward office. Submission by mail or electronic application via the Mynaportal is also available. If you are continuing to use the system from last year, return the application postcard once it arrives.

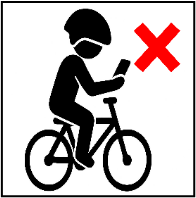

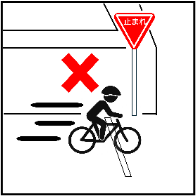

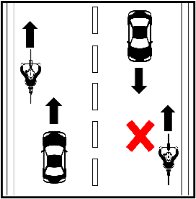

Fines will be introduced for bicycle traffic violations!

From April, the traffic violation notification system, commonly known as the blue ticket, will apply to more than 100 types of bicycle violations, such as ignoring traffic lights and using a smartphone while riding. Under this system, offenders who pay the fine will not face criminal penalties. The applicable age is 16 years and above, and the penalty will be the same as that imposed for violations involving motorised bicycles (mopeds). Let’s follow bicycle traffic rules and be careful to avoid both causing accidents and being involved in them.

・Use of mobile phones, etc. (holding in hand) 12,000 yen

・Use of mobile phones, etc. (holding in hand) 12,000 yen

・Failure to stop at a stop sign 5,000 yen

・Failure to stop at a stop sign 5,000 yen

・Riding on the right side of the road 6,000 yen

・Riding on the right side of the road 6,000 yen

Reduction of National Health Insurance Premium Before and After Delivery*1

From January 2024 onward, if a household enrolled in National Health Insurance has an insured person who is expected to give birth or has given birth, the per-income and per-capita portions of the premium attributable to that insured person will be fully reduced, thereby lowering the household’s insurance premiums.

Eligibility: Those enrolled in National Health Insurance whose expected delivery date (or actual delivery date) is November 2023 or later.

Reduction period: 4 months from the month before the expected/actual date of delivery

(for multiple births, it will be 6 months from 3 months before the month of expected/actual date of delivery).

Necessary documents: Documents that show the National Health Insurance code and number, documents that can confirm the applicant’s personal identity*2, and a document that can confirm the expected/actual date of delivery, such as the Maternal and Child Health Handbook.

Notification*3: From six months before the expected delivery date, apply in person at the Health Insurance and Pension Division of the ward office or via the Sakai City e-application system.

*1 Any pregnancy lasting 85 days or more (approx. 4 months), including cases such as premature delivery, stillbirth, or miscarriage.

*2 Passport, driver’s license, or My Number Card, as well as other licenses issued by government agencies (limited to those with the holder’s photo attached).

*3 A power of attorney is needed if a person outside of the household comes to the ward office.

National Pension Contributions Exemption Before and After Delivery*1

Payment of contributions to the National Pension before and after giving birth will be exempted upon notification. The exemption period will be counted toward your basic pension benefits, and you can still make additional contributions if you wish.

Eligibility: Primary insured person whose date of delivery is February 1st, 2019 or later.

Exemption period: 4 months from the month before the expected/actual date of delivery (for multiple births, it will be 6 months from 3 months before the month of expected/actual date of delivery). However, it is limited to the period of April 2019 and after.

Necessary documents: Documents that can confirm the applicant’s personal identity*2, and a document that can confirm the expected/actual date of delivery, such as the Maternal and Child Health Handbook.

Notification*3: From 6 months before the expected delivery date, submit directly to the Health Insurance and Pension Division at the ward office, by mail, or via online application through the Mynaportal application system.

*1 Any pregnancy lasting 85 days or more (approx. 4 months), including cases such as premature delivery, stillbirth, or miscarriage.

*2 Passport, driver’s license, or My Number Card, as well as other licenses issued by government agencies (limited to those with the holder’s photo attached).

*3 A power of attorney is needed if a person outside of the household comes to the ward office.

Do you know about the foster care system?

There is a shortage of foster parents who can temporarily care for children unable to live with their families for various reasons. Why not take this opportunity to learn more about the foster care system?

For more details click here (Japanese only).